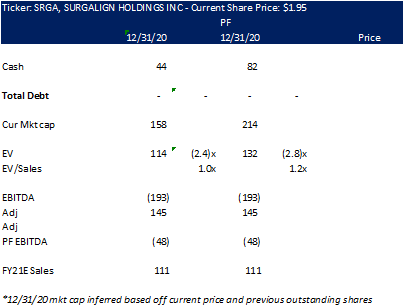

*PF for 1/28/21 cap raise

Thesis

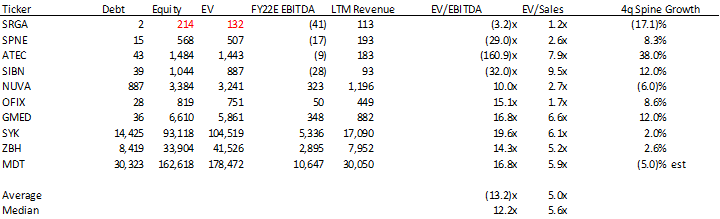

- SRGA is a cheaply valued turnaround story trading below comps with significant upside. Assuming just a return to median EV/sales of the industry would result in a ~4x higher EV/share price.

- ATEC/SPNE provide clear playbook on return to growth and multiple expansion

- Including $42MM already paid for Holosurgical implies core Spine business value of even lower than 1.2x

- Comp acquisitions at significantly higher multiples, Paradigm Surgical at ~3.8x, Average comps at ~5x

- Valuations typically based off revenue growth

Situation Overview

- RTI Surgical was a small orthopedics company that was experiencing operations headwinds and accounting issues in 2020. Original turnaround began in 2017 with hiring of Camille Farhat.

- Company realized being ortho player was not competitive and needed to re-align to become pureplay spine implants company

- RTI Surgical purchased Paradigm Spine in 2019 and sold its OEM orthopedics group in July 2020 for $440MM. After selling the OEM group became pureplay spine company and renamed itself Surgalign.

- Entire C-suite is new, CEO Terry Rich from ATEC and has experience with spine co turnaround

- Terry Rich – Spine industry veteran, experience at ATEC, Wright Medical, NUVA. Led turnaround of ATEC from 12/16 to 12/18

- Jonathan Singer was new CFO starting September 2017 when Camille Farhat originally brought on to turn around company

- SEC investigation into accounting for periods from 2014-2016 caused delay of 10-K and material restatements preceding current CFO’s oversight. Ultimately restated financials from 2014-2018

- Chief Commercial officer Scott Durall new June 2020, has experience from NUVA

- Doug Bireley Marketing/R&D started August 2020, previous experience at JNJ/DePuy

- Chief Medical Officer Kris Siemionow – acquired from Holosurgical

- Surgalign purchased Holosurgical in Sept 2020 for $42MM in cash and up to $125MM in future milestone payments

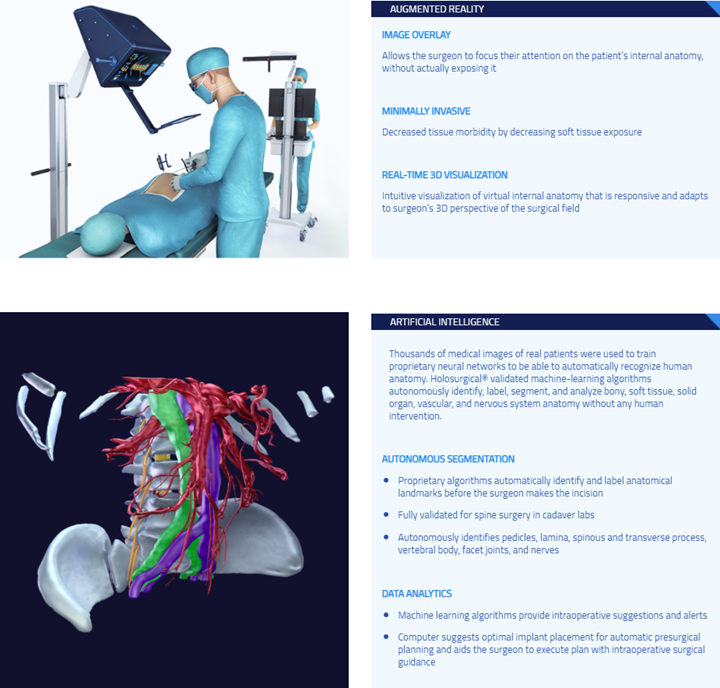

- Holosurgical is a promising surgical operating AR tool with some unique features surrounding ability to identify soft tissue

- Primary competitors include Augmedics and Stealthstation from Medtronics

- AR/AI tool promises to lower surgeon operating errors, improve prep time, and improve navigation

- Midpoint of expected FY21 revenues of $111MM

- Competitive set: SRGA/SPNE/ATEC/NUVA/OFIX/SYK/ZBH/MDT/JNJ

Reasons to Like

- Small innovative pureplay spine company turnarounds have seen multiple successes in industry, Terry Rich also has direct experience with success story ATEC

- Including capital spent on Holosurgical, pureplay remaining spine company trading at large cheap discount to comps providing strong margin of safety

- Holosurgical offering is unique in industry and provides a significant differentiator to pull-through implant sales if it is successful

- Trading at 1.2x EV/Sales, implies core Spine biz excluding Holosurgical at ~0.8x EV/Sales

Reasons for Concern

- FY21 will be a transition year to execute on Holosurgical

- Small scale versus ortho comps MDT/SYK/NUVA/JNJ

- Spine industry competition is aggressive and typically experiences LSD pricing pressure

- Hospitals tend to try to consolidate vendors and favor larger generic orthos that can compete by bundling discounts in other orthopedics

- Larger ortho competitors pursuing robotics, in the event of fully automated surgery room may not need augmented reality

- Company expected to burn cash for foreseeable future

- Auditor recently resigned – while concerning we note the entire mgmt team is effectively new and financial statements have already been extensively restated

Recent Events

- Deloitte resigned as auditor 4/8/21

- Capital raise of $37.5MM in 1/28/21, mgmt/board purchased ~$5MM in shares at ~$1.50

- Purchased Holosurgical 10/23/20

- Sold OEM business Montagu Private Equity for $440MM on 7/20/20

- Paradigm Spine acquired for $100MM cash, $50MM shares, and $150MM in contingent payments

Upcoming Catalysts

- Holosurgical FDA 510(k) filing in April/May 2021

- Holosurgical FDA 510(k) approval likely 4Q21

- Quarterly earnings expected 5/14, 8/7, 11/11

Business Overview

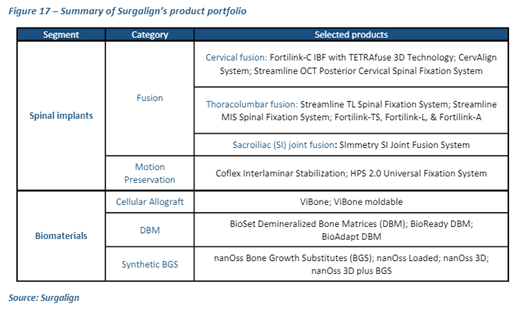

- Surgalign was formed in 1997 from the UoF Tissue Bank and acquired Pioneer Surgical in 2013, Zyga Technology in 2018, and Paradigm Spine in 2019.

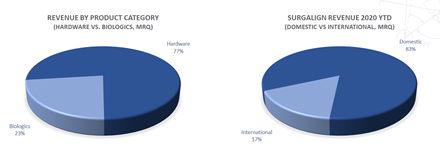

- Sells spine implants to hospitals and surgeons, typical revenue/procedure today at $6.5k-$9k

- Paradigm Spine provided Coflex treatment for Lumbar Spinal Stenosis, 2018 revenues of $40MM or ~3.8x EV/Sales excluding contingency

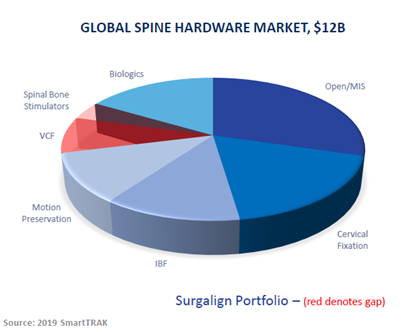

- Spine implants tend to be a commodity with some differentiation. Distribution and iterations of new products versus legacy products tend to drive revenue growth. New navigation technologies are an avenue for potentially deeper differentiation.

- Covers 87% of core spine surgeries and biomaterials cover 70% of cases

- Cross sells with AZYO biologics for ViBone moldables

Source: Company Investor Day

Source: BTIG

Holosurgical

Industry Overview

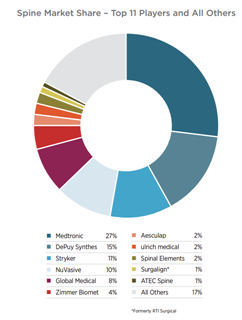

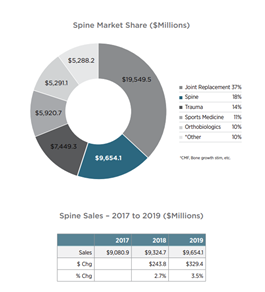

The largest players in the industry are MDT/NUVA/SYK/JNJ. SYK/JNJ/ZBH are large generic orthopedics players that also cover spine while the remaining tail is somewhat specialized toward being pureplay spine companies. Companies typically can compete with discounts or on price with bundling and typically new innovations are responsible for driving growth.

Source: Orthoworld, Spine Market Data and Infographics

Source: Orthoworld, Spine Market Data and Infographics

Relative Value

ATEC Turnaround starting 2016 – Terry Rich hired December 2016

Disclosure

I/we own shares of SRGA. The above posted information is not meant to be investment advice, please consult with an investment advisor and do your own due diligence before ANY investment.

Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of the publication and are subject to change.