PRTH is the 11th largest merchant acquirer in the US, trades cheap to comps, has returned to growth, and potentially has 2-3x upside from current prices.

Situation Overview

- PRTH has had a challenging 2 years with a damaging change in Mastercard e-commerce standards, accounting revision, and COVID

- Multiple things in the story have now changed that deserve a 2nd look

- Grew organically and cycled Mastercard change 4Q19 pre-COVID

- Hired new CAO, CFO, and Auditor

- Barring further shutdowns worst of COVID may be cycled

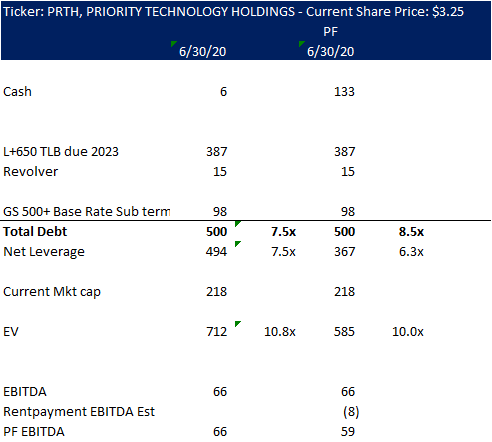

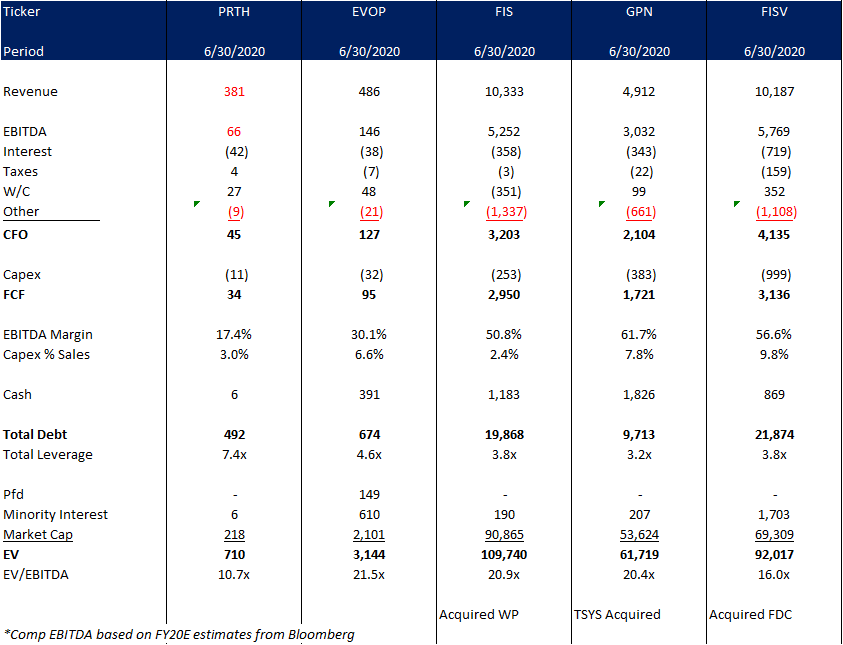

- PRTH trades cheap to comps at ~11x EV/EBITDA with comps trading at 16-22x

- PRTH has cycled the loss of e-commerce subscription related revenues that plagued 2018/2019 and had reported 31% y/y PF Adj. EBITDA growth in 4Q19 prior to COVID

- PF revenue growth excluding e-commerce subscription declines was 12% in FY19

- PRTH announced on Sept. 1 a sale agreement of its RentPayment business to MRI Software for $180MM ($127MM proceeds to PRTH)

- 2Q20 revenues grew 0.2% y/y while adj. EBITDA grew 8.0% y/y despite headwinds from COVID

- Consumer Payments dollar value declined 16.4% y/y

- Commercial Payments dollar value declined 13.8% y/y

- Integrated Partners dollar value grew 15.0% y/y

Reasons to Like

- Underlying organic growth in industry and PRTH excluding e-commerce subscription customers has been healthy and demands a high multiple

- Per the Federal Reserve core non-cash payments grew 6.7% y/y from 2015-2018

- Integrated merchant acquirers create differentiation in niche markets that are tough for large players to address in a generic fashion

- PRTH trades at ~11x EV/EBITDA, extremely cheap to comps (16-22x), EVOP likely the closest comp trades at ~22x

- Multiple expansion to comps implies 2-3x upside from current trading prices. PRTH likely still should trade at a slight discount to peers as processing is outsourced to First Data/TSS

- With sale of assets to MRI Software potential credit related concerns should be mitigated as the company will have sufficient liquidity to de-lever

- Term loan facility has 7.75x leverage covenant with stepdowns

- Asset sale to MRI appears to have flipped the 2019 acquired Yapstone business ($65MM cash + 6% interest valued at ~$6MM) for $127MM.

- PRTH is under-covered by sellside and market has missed significant changes in the business

- Aligned mgmt. incentives – 82% of shares held by Priore family

- Board member with history as ex-CEO of Elavon and Chase Merchant Services has been acquiring shares

Reasons for Caution

- Merchant acquiring is commoditized and there are significant competitive benefits to scale

- Margins as % of dollar value processed face consistent price competition and larger competitors are able to offset some with scale

- Highly reliant on outsourced sales – 85% of COGS is commissions to ISVs. Outsourced sales organizations have limited non-financial incentive to sell PRTH.

- COVID impact on SMBs remains unclear in longer-run and may present headwind to growth as PRTH’s most valuable business is SMBs

- Priore family controls ~82% of shares – while incentives are aligned there is risk to minority shareholders in terms of corporate governance

- CTO has been selling shares – Started selling shares in April 2020 near lows though still retains a healthy amount of shares

- PRTH restated its financial results and has cited weakness in internal controls since reverse merger in 2018 – PRTH recently hired E&Y and replaced RSM as well as a new CAO in April which should hopefully address this

Ecommerce Subscription Challenge

- In 2Q18 PRTH announced it was closing accounts of 1,200 merchants to ensure compliance with an industry-wide change in Mastercard standards regarding management of subscription billing, ecommerce, and merchants

- Company had expected to receive guidance in May 2018 but was delayed until October which delayed ability to re-onboard certain of the merchants

- Impacted accounts reflected $99MM of FY17 rev, $59MM on FY18, and $9MM on FY19 revenues

- Further summary – https://www.chargebackgurus.com/blog/understanding-the-2018-visa-mastercard-mandate-for-subscription-transactions

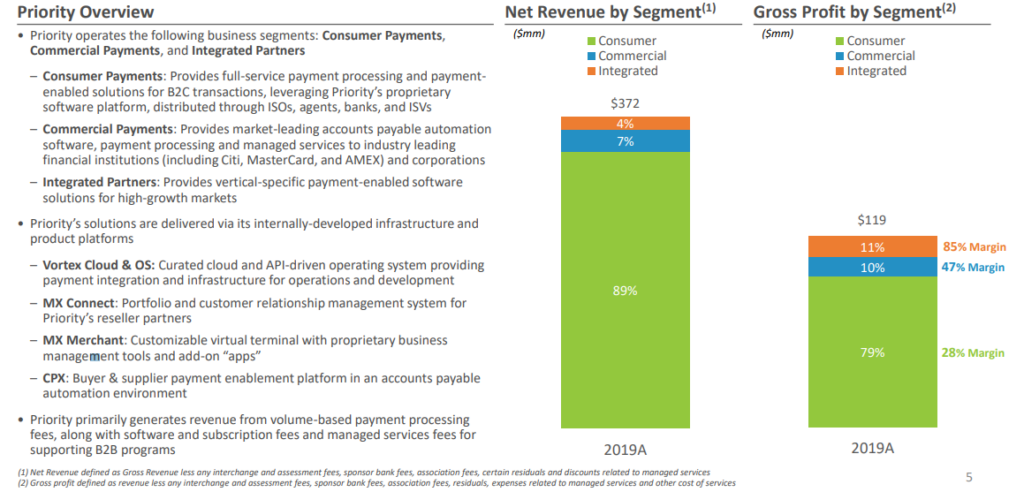

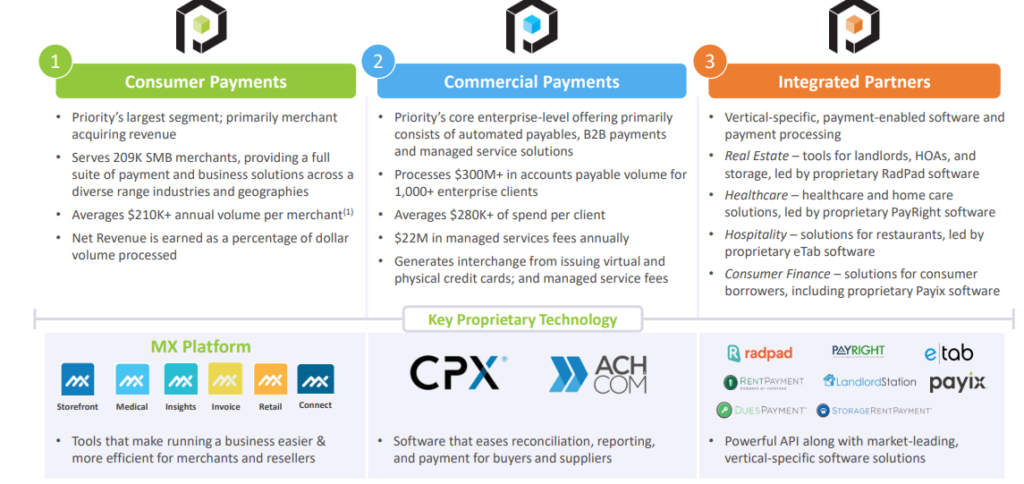

Business Overview

- PRTH was founded in 2005 and taken public in a reverse merger with MI acquisitions in 2018

- PRTH is the 11th largest merchant acquirer in the US with 513mm transactions and over $43B of dollar value in FY19

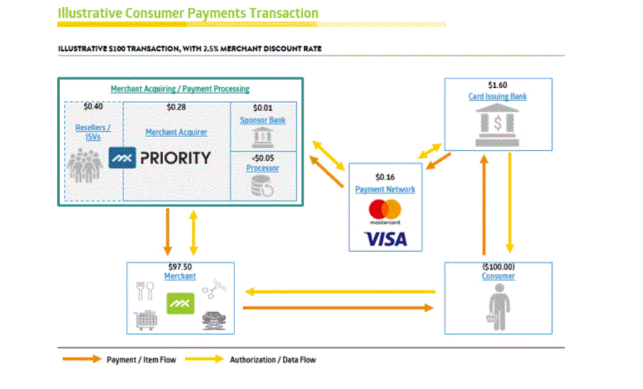

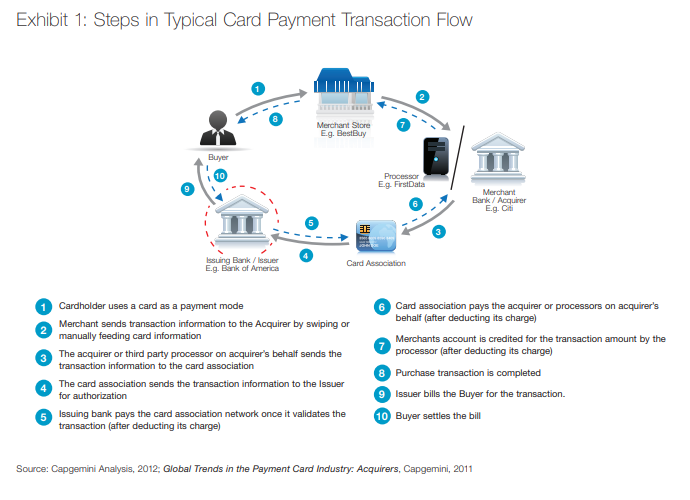

- Merchant acquirers essentially help the merchant accept credit card payments and act as a link between merchants, card issuers, and payment networks providing authorization, clearing, settlement, dispute management, and information services to merchants

Source: PRTH Investor Presentation June 2020

Industry Overview

- Overall industry growth expected to be mid-high single digits driven by continued replacement of non-cash/check payments by other forms

- Priority Tech sits as a merchant acquirer which owns the merchant relationship and provides an integrated payment processing solution for merchants

- Transactions are typically on a % of volume basis for smaller merchants which can shift to $/transaction for larger merchants

- Scale is important due to processing fees and cost of acquisition, ultimately merchant acquiring is still a commodity business

- Industry dominated by GPN/FIS/FISV in the US as well as major banks including Chase, BofA, Wells Fargo, Elavon/USBancorp

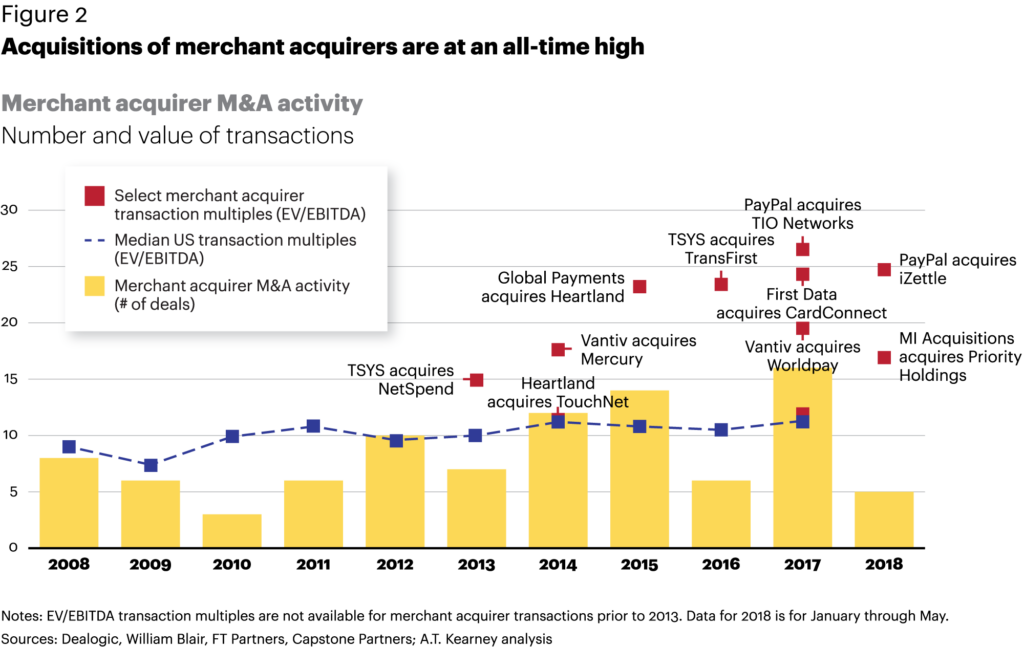

- Multiples in the industry have consistently expanded since 2010 and industry has consolidated with notable megamergers in the past few years including Worldpay/FIS, TSS/GPN, and FDC/FISV

Relative Value

Disclosure

I/we own shares of PRTH. The above posted information is not meant to be investment advice, please consult with an investment advisor and do your own due diligence before ANY investment.

Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of the publication and are subject to change.