Thesis

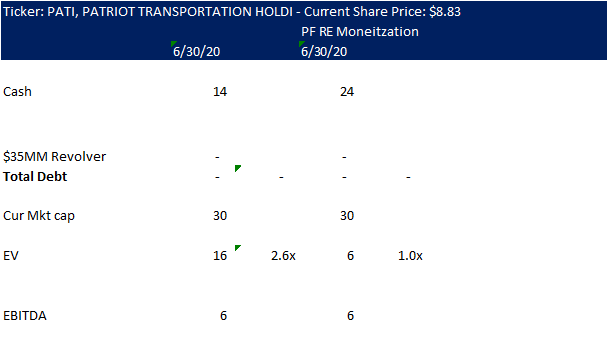

Patriot Transportation is an attractive asymmetric oil trucking play with a call option on oil demand. 2.6x EV/EBITDA is extremely cheap and is trading at 1x EBITDA adjusted for a potential real estate sale in the future. At current prices we believe there is upside with fuel volume normalization to $20 a share, in the area where the company was trading pre COVID.

Situation Overview

PATI has been an underfollowed and underperforming liquids tank carrier spin-out from FRPH in 2015. The company struggled has struggled since the spin-out with truck driver shortages which caused an inability to service customers. PATI currently trades at 2.6x EV/EBITDA and has highly valuable real estate value the company is trying to unlock. The company is 33% owned by the Baker family and affiliates who were previously purchasing shares around current prices as recently as March.

Reasons to Like

- PATI is extremely cheap and trading at distressed fire sale prices

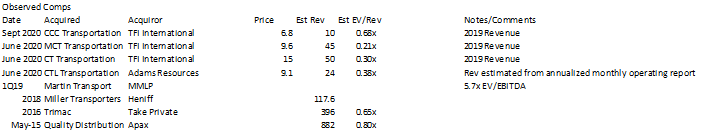

- PATI has historically traded in the 3-5x EV/EBITDA area, comps have been bought in the 0.6-0.8x EV/Sales area during more normal times

- Recent Comcar bankruptcy marks a distressed valuation that is above the current EV/Sales for the company

- Mgmt does understand the need for efficient capital allocation and the company issued a $3 special dividend in January

- The company achieved positive EBIT during 3Q20 despite a 31% decline in revenues

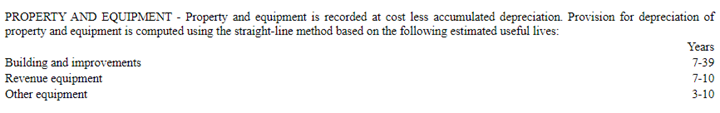

- PATI is likely over-depreciating assets as evidenced by annual gains on sale of PP&E

- As such using just book tangible P&E implies large margin of safety from asset values

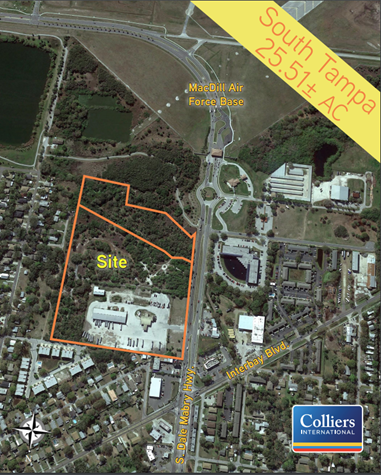

- While cancelled due to COVID related concerns, PATI was on the verge of monetizing the land for its terminal in Tampa for $10MM. We think the land is likely still highly valuable given where it sits once COVID normalizes and the company now has gotten city approval for re-development.

- Mgmt is trying to scale down into more profitable contracts and results are beginning to bear fruit with revenue/mile increasing ~5-6% y/y in 2Q20/3Q20

Reasons for Caution

- There remains an acute structural truck driver shortage and COVID negatively impacted the schools that train new commercial drivers

- Mgmt and the company have struggled to overcome industry challenges which led to poor 2019 results

- Mgmt has a desire to opportunistically acquire companies though if they fail to integrate them well it could destroy capital

- Oil market has been soft and transportation revenues with it, while there has been some recovery from increased leisure demand volume will likely not return until demand from commuters returns

- PATI has a scale disadvantage versus industry leaders

- Trucking is a highly commoditized business

- A prolonged distressed cycle could cause other trucking providers to become irrational on price

- Baker Family/affiliates own ~33% of the company and could pursue actions unfavorable to other shareholders

- Customer concentration – 10 largest customers were 63% of revenue, Murphy USA was 19% of revenue

Business Overview

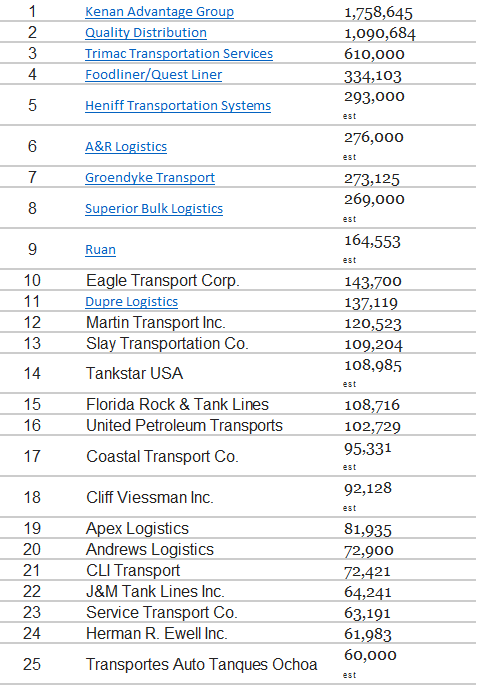

Patriot Transportation is the 13th largest tank truck/bulk carrier in the US per Transport Topics News operating under Florida Rock & Tank Lines. PATI was originally spun out of FRPH in 2015 with the intention to use its pureplay tank truck equity as a currency for rolling up the highly fragmented tank truck segment of the transportation business. As of 6/30/20 PATI had 455 drivers operating 323 company tractors, 19 owner/operated tractors, 452 trailers, and 18 terminals and 6 satellite locations in Florida, Georgia, Alabama, and Tennessee.

86% of revenues are from petroleum hauling and 14% from dry bulk. In petroleum hauling PATI hauls fuel from large scale storage facilities to retail outlets and in dry bulk hauling PATI hauls products like cement, limestone, and various industrial powders to end user sites. Contracts are generally terminable upon 90-120 days notice however 9/10 customers have been customers for over 5 years.

Recent Quarter Results

Revenues declined 30.9% y/y to $19.0MM while EBITDA declined 5.1% y/y to $2.4MM. EBITDA margin improved 3.4pts y/y to 12.5%. In April volumes declined 35-40% y/y from pre-covid levels and have now settled around 10-20% below normal. The company was too large to qualify for CARES act benefits and they closed their Wilmington North Carolina facility.

Industry Overview

The tank transportation industry is highly fragmented and the largest player in the space is Kenan Advantage with $1.8B in revenues. The industry is commoditized and highly cyclical with demand dictated by end user demand for oil/petroleum products on the liquids side and industrial applications on the dry bulk side. Fuel transportation is exceptionally cyclical given the large swings in gas demand correlated to economic activity while specialty chemicals may be more insulated depending on the application.

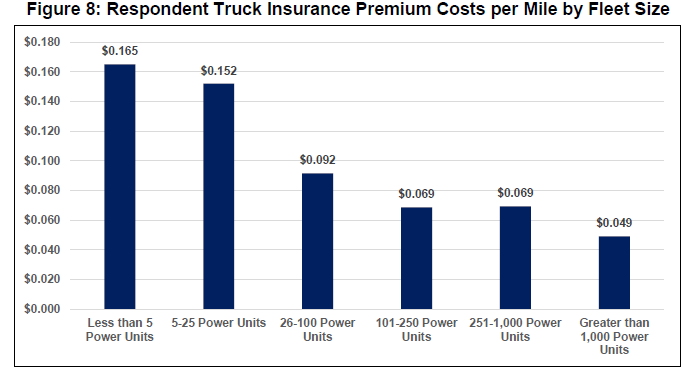

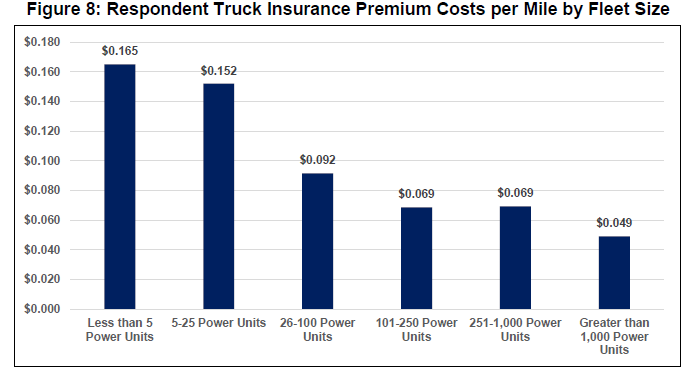

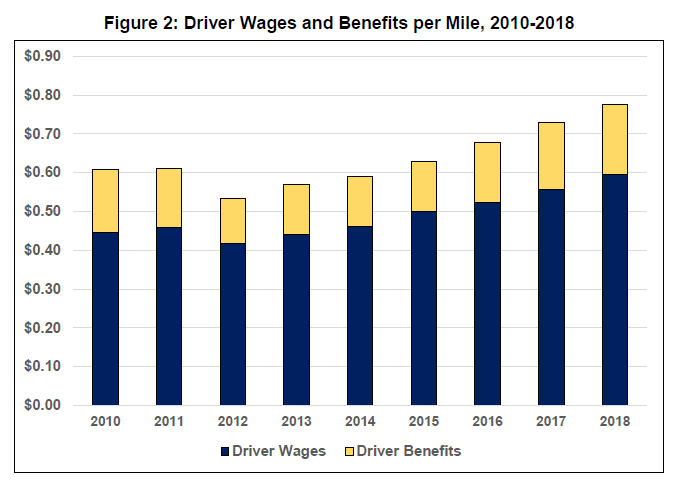

The key driver of competitiveness for the industry is scale and regional operating density. Typically there is a fixed cost per new terminal in a region and incremental volume in the same region is what drives profitability. Scale in the industry is highly important as it can provide significant procurement advantages on fuel costs, insurance costs, and driver procurement. Driver shortages and increasing insurance costs remain two of the largest headwinds in the industry that will likely continue to structurally destroy profitability for sub-scale players. Tank truck hauling has additional challenges relative to normal trucking for finding drivers as the loads are potentially more dangerous and require safer and more experienced drivers. Ultimately as an industry higher driver wages and insurance fees should be passed through in increased rates over time.

From the American Transportation Research Institute’s 2019 operational costs of trucking update:

Top 25 bulk tank carriers by 2019 revenue

Source: Tank truckers News top 100

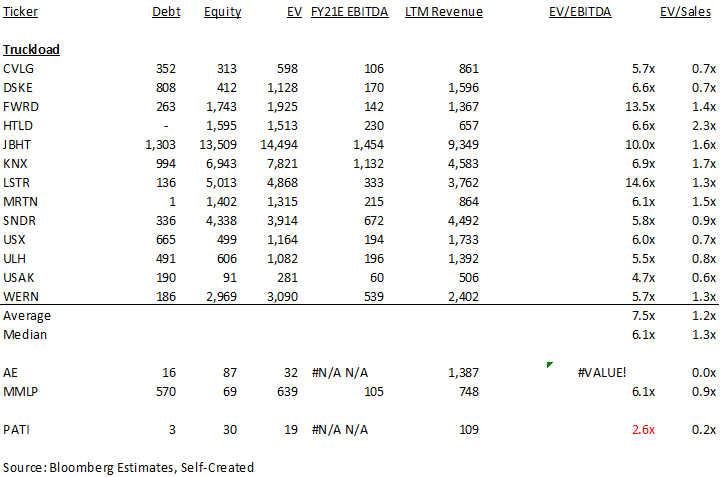

Valuation Comps

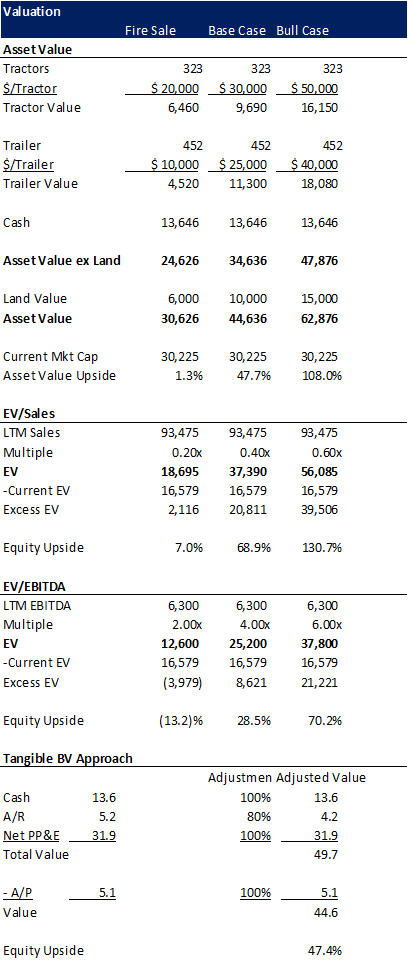

We approach valuation from multiple angles: relative comp multiples, recent observed acquisitions, estimated replacement value based on the observable used market, and tangible book value. All approaches imply significant margin of safety at current prices in our base case.

From a relative comp multiple it’s fairly clear PATI is trading cheap though there are no great pureplay bulk tank carriers that are publicly traded. AE and MMLP have small transportation businesses (AE acquired CTL Transportation recently from the Comcar BK and MMLP recently acquired Martin Transportation). General truckload carriers average around 7.5x EV/EBITDA and 1.2x EV/Sales, both home runs were PATI to achieve those multiples. PATI has historically traded more in the 3-5x EV/EBITDA and 0.4-0.6x EV/Sales range prior to COVID.

Recently Observed

Recently observed comps indicate closer to a ~0.6x-0.8x EV/Sales multiple pre-COVID while during post-COVID distress the lowest EV/Sales was from the acquisition of different segments of Comcar at 0.21x. Adams acquisition of CTL Transportation is likely the closest recent bulk liquids carrier data point and EV/rev was 0.38x based off annualized $2MM of revenue disclosed in the monthly operating report for June.

Asset Value

PATI owns 3 main sources of identifiable asset value: 323 trucks/tractors, 452 tanker trailers, and 13 terminals spread across Florida, Georgia, and Tennessee. New tractors can cost over 110k and new trailers cost 30-50k before upgrades which can increase the cost of the tank to over 100k. Per the American Trucking Research Institute, tractors average about a 7 year useful life and trailers average 13 years. I assume the average age of the tractor fleet is ~4 years with ~400k miles based on ~95k revenue miles/truck driven in FY19. This is in-line with what is implied by accumulated depreciation of 62% of gross PP&E on the balance sheet as of 6/30 versus revenue equipment depreciation curves of 7-10 years.

Used tractors in the 300-500k mileage area after 2015 are listed from between $20k to $60k per Commercial Truck Trader. Used tank trailers that have a 2010-2013 vintage list from $15k to $40k. We conservatively apply a $30k/used tractor and a $25k per used tanker trailer for our base case valuation.

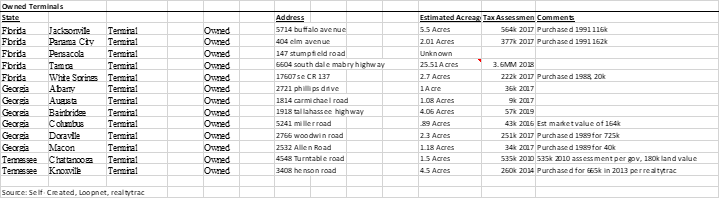

The remaining sources of value are the terminals owned by PATI. The ones that jump out are the >100k estimated tax assessment properties per realtytrac with the crown jewel being the property at 6604 South Dale Mabry in Tampa Florida. This 25 acre property has been the target of an over decade long attempt at re-development but recently prior to COVID there was interest in purchasing the property for $10MM for a retail redevelopment contingent on zoning approvals. The company received zoning approvals but the bidder dropped out in early September due to concerns from COVID. We believe the long-term value of the re-development has not changed and the land is likely still highly valuable especially since it is located in Florida, an expected beneficiary of COVID related relocation activity. Based on this property alone we think there is likely at least $10MM of asset value in the land that could be unlocked in the future with potentially another $3-5MM from the other properties in Jacksonville, Panama City, Doraville, Chattanooga, and Knoxville.

Conclusion

PATI is extremely cheap relative to comps across trucking and trading at a discount to even recent publicly visible valuations achieved in the Comcar bankruptcy fire sale. We think Comcar is probably a highly conservative mark on the potential value of the company and should be viewed as a reasonable floor from an EV/Sales valuation basis. We think there is a reasonable chance of upside and normalization to a 0.6x EV/sales multiple which implies a potential price of ~$20/sh. The company has been focused on right-sizing the ship and was profitable in the most recent quarter. Even from an asset basis the company is trading at below highly conservative fire sale levels for tractor/trailers before taking into account likely significant land value as well as actual enterprise value for what was an EBIT positive business at the peak of the pandemic in 2Q.